The Indian luxury real estate market is fast becoming the preferred choice for NRI investment in India. Over the past few years, Non-Resident Indians have shifted from mid-segment housing to premium and ultra-luxury properties, driven not just by emotions of owning a home back in India but also by the strategic financial edge these properties offer. Rising property prices, attractive returns, favorable currency conditions, and global-standard lifestyle offerings have made luxury property investment in India for NRIs one of the safest and most lucrative opportunities.

Why Are NRIs Investing in Indian Luxury Real Estate?

NRIs are investing in Indian luxury real estate because of higher remittances, favorable foreign exchange rates, RERA-backed transparency, stable appreciation in property values, and the prestige of owning world-class homes in cities like Mumbai, Delhi NCR, Bangalore, Pune, and Hyderabad. This blend of financial growth, lifestyle prestige, and emotional value makes luxury property the top choice for Indian diaspora investors.

Key Drivers of the NRI to Invest in Luxury Real Estate

- Record remittance flows: India received over USD 135 billion in remittances in FY25, the world’s highest, allowing NRIs to channel wealth into premium properties.

- Regulatory reforms: With RERA and digitization, buying luxury property in India for NRIs is safer than ever.

- Favorable exchange rates: A weaker Indian rupee gives NRIs in the US, UK, UAE, and Canada stronger purchasing power.

- Prestige factor: Elite projects in Mumbai, Gurgaon, Bangalore, etc., rival international standards and secure long-term appreciation.

ROI Overview for NRI Investing in Luxury Real Estate Apartment

NRIs investing in luxury apartments in India are seeing strong returns, with average annual ROI combining both rental yield and capital appreciation. Typically, luxury properties deliver rental yields ranging from 2.5–4% per annum, while capital appreciation often averages 8–12% per annum in top cities like Mumbai, Gurgaon, Bangalore, Pune, and Hyderabad. This means NRIs can expect total returns of 10–15% annually, depending on the market and project quality.

Investing in Luxury Real Estate Apartments Offers Exclusivelny For NRIs:

Factors like RERA compliance, developer reputation, and city growth rates further enhance the probability of achieving robust returns

- Stable rental income (generally 2.5–4%) due to high demand from affluent tenants in prime locations.

- Capital appreciation (usually 8–12%) is driven by rising property prices, limited inventory, and urban infrastructure development.

- In markets like Pune, Hyderabad, and Bangalore, total returns can be even higher if the property is well-located and amenities-rich.

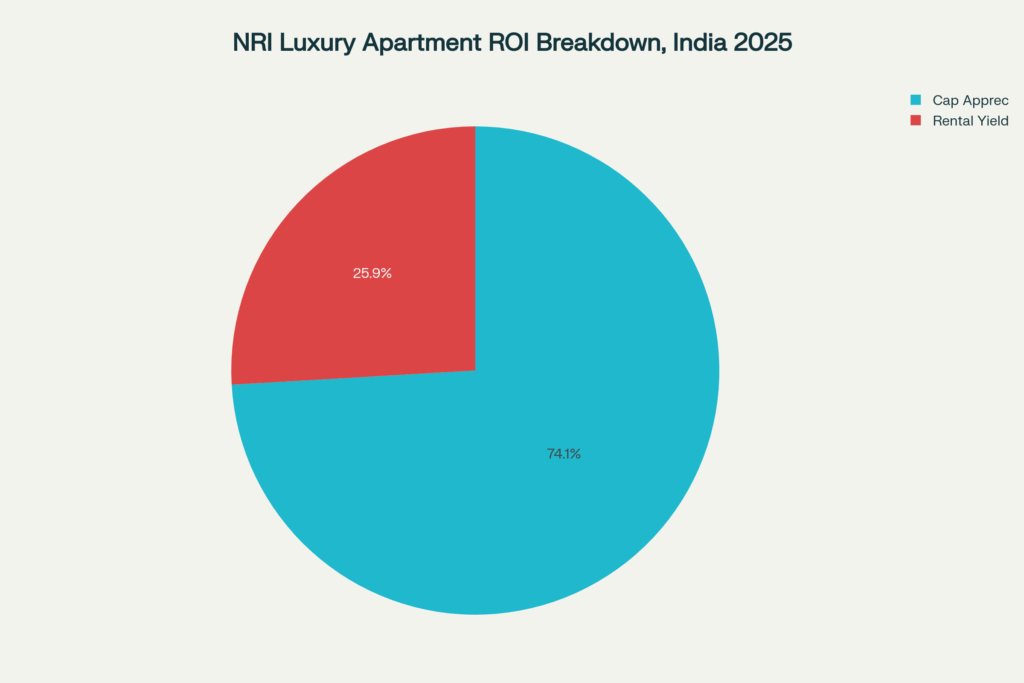

ROI Breakdown: Pie Chart

NRI investors in luxury real estate apartments typically see about 3.5% return from rentals and 10% from price appreciation annually, based on 2025 market averages

Best Cities Where NRIs Can Buy Luxury Real Estate Property in India

The best cities for NRIs to buy luxury property in India are Mumbai, Delhi NCR (Gurgaon), Bangalore, Pune, and Hyderabad—each offering unique advantages such as prestige, capital appreciation, rental income, or affordability.

Mumbai: India’s Billionaires’ Row

- Altamount Road, Malabar Hill, Bandra, and BKC are prime luxury addresses.

- Iconic projects include Lodha Altamount, The World Towers, and Signature Island.

- Mumbai luxury segment crossed ₹14,750 crore in transactions in H1 2025, showing enduring NRI demand.

Delhi NCR & Gurgaon: Super-Luxury Capital

- Projects like DLF The Camellias, Trump Towers Gurgaon, and The Crest are notable examples.

- Golf Course Road properties attract over 20% NRI buyers.

- Gurgaon luxury sales broke records with over ₹11,800 crore booked in under two months.

Bangalore: The Tech Hub with Lifestyle Appeal

- Hotspots: Whitefield, Koramangala, Indiranagar.

- Luxury units priced at ₹8,000–₹18,000 per sq.ft with higher rental yields (3–4%).

- Popular projects include Prestige Kingfisher Towers.

Pune & Hyderabad: Affordable Luxury

- Pune’s Koregaon Park and Baner are NRI favorites with yields up to 4.5%.

- Hyderabad’s Gachibowli and Kokapet offer affordable luxury at ₹9,500–₹12,500 per sq.ft.

- Both emerging markets offer high capital growth and balanced ROI.

Investment Strategies & Policies for NRIs

- Know regulatory frameworks: Only purchase RERA-approved luxury projects.

- Financing options: Use NRI home loans with repayment via NRE/NRO accounts.

- Manage forex: NRIs from UAE/US/UK/Canada benefit the most during a weak rupee cycle.

- Tax rules: Rental income taxable but protected under DTAA; capital gains taxed at 20% after 2 years with indexation.

- Repatriation: NRIs can send back up to USD 1 million annually.

What Defines the Best Luxury Property in India?

Prime locations, large layouts, world-class amenities, sustainability, and high-security features define the best luxury properties in India for NRIs. Examples include Trump Towers Gurgaon, DLF Camellias, Prestige Kingfisher Towers, Lodha Altamount, and The World Towers in Mumbai.

Key Features:

- Prime locations (Sea-facing Worli, Golf Course Road, Indiranagar)

- Expansive layouts (3,000 – 10,000 sq.ft)

- High-end amenities: concierge, private elevators, wellness spas, sky gardens

- Smart home technology & sustainability certifications (LEED, IGBC)

- Round-the-clock security

Market Performance & ROI Trends

- Luxury sales growth: Homes above ₹1 crore contributed 62% of sales in H1 2025, up from 51% the previous year.

- Price appreciation: Premium metros expected to rise by 6.5% CAGR in 2025.

- Rental yields: Higher in Bangalore, Pune & Hyderabad (3–4%).

- Low vacancy rates: Below 5% in ultra-luxury properties.

Conclusion: Why Now is the Right Time for NRIs to Invest in Luxury Real Estate

For NRIs, buying luxury property in India blends lifestyle, financial appreciation, and legacy value. From Mumbai’s prestige to Gurgaon’s ultra-luxury towers, Bangalore’s ROI potential, and Pune/Hyderabad’s high-growth affordability, every major metro offers unique advantages. With strong remittance inflows, favorable currency dynamics, and transparent regulations, Indian luxury real estate is truly the new face of NRI investment.

Actionable Investment Tips for NRIs Before Investing in Luxury Real Estate

- Define your goal: rental income, long-term growth, or legacy value.

- Select the right city based on ROI and lifestyle needs.

- Always choose RERA-approved luxury projects.

- Opt for ready-to-move properties for lower risk.

- Use professional legal and tax advisors.

- Route transactions strictly via NRE/NRO accounts.

.For NRIs looking to combine emotional ties with smart investment, Indian luxury real estate offers an unmatched opportunity in 2025. The market’s resilience, supported by strong remittances, favorable currency conditions, and enhanced regulatory transparency, assures both lifestyle prestige and robust financial returns. Whether as a secure asset for wealth growth, a premium rental income source, or a luxurious vacation home, investing in RERA-approved luxury properties across Mumbai, Gurgaon, Bangalore, Pune, and Hyderabad is a strategic choice. With the right guidance and clear investment goals, NRIs can confidently build a legacy that stands the test of time while enjoying the pride of owning a world-class home in their homeland.

By following these steps, NRIs can secure the best luxury property investment in India, ensuring wealth growth, global lifestyle standards, and pride of ownership

Frequently Asked Questions(FAQ’s) About Luxury Real Estate

1. Should NRIs buy ready-to-move or under-construction properties?

Ready-to-move luxury flats for NRIs in India are safer, eliminate delays, and generate immediate rental income. Should NRIs buy ready-to-move or under-construction properties?

2. Can I invest from UAE/UK/US/Canada without visiting India?

Yes. NRIs can invest in Indian property from abroad using digital registrations, virtual site tours, PoA documentation, and NRE/NRO accounts.

3. Which Indian city offers the best ROI for NRIs?

Mumbai: Best for prestige and appreciation

Gurgaon: Ultra-luxury and resale value

Bangalore: Strong rental yields

Pune & Hyderabad: Affordability + high growth potential

Are luxury properties a safe investment for NRIs?

Yes, RERA-approved luxury projects in India give NRIs complete transparency, secure investments, and guaranteed delivery timelines.